Why You Should Invest in Forestry

- August 6, 2024

- 0 comment

Invest in Forestry is increasingly popular as investors discover its unique blend of financial, environmental, and social benefits. Unlike conventional investment options, forestry provides a sustainable avenue for wealth accumulation.

This type of investment not only promises potentially high returns but also supports environmental conservation efforts. By investing in forestry, individuals contribute to the health of the planet. This dual impact makes forestry investments both lucrative and eco-friendly, appealing to a growing number of investors.

Understanding Invest in Forestry

Forestry investments have gained significant interest over the past few decades, evolving from a niche to a core part of institutional investment portfolios. Here is an overview of the key aspects and benefits of forestry investments:

- Definition and Basics: Forestry investments involve purchasing, managing, and selling forests or timberland for profit. Investors can earn returns through timber sales, land appreciation, and ecosystem services such as carbon credits.

- Types of Forestry Investments: Forestry investments can take various forms, including direct ownership of timberland, forestry funds, and shares in forestry companies. Each type offers different levels of involvement, risk, and return potential.

Economic Benefits of Investing in Forestry

Investing in forestry offers a range of economic benefits, including sustainable wealth creation, environmental value, and social impact.

- Financial Returns: Invest in Forestry can yield significant financial returns. Timber prices tend to rise over time, and mature forests can be highly profitable when harvested sustainably. Additionally, land values typically appreciate, providing another avenue for capital growth.

- Long-term Investment Security: Invest in Forestry offer long-term security as trees grow over decades, providing a steady and predictable income stream. This makes forestry a resilient investment against economic fluctuations.

Environmental Impact of Forestry Investments

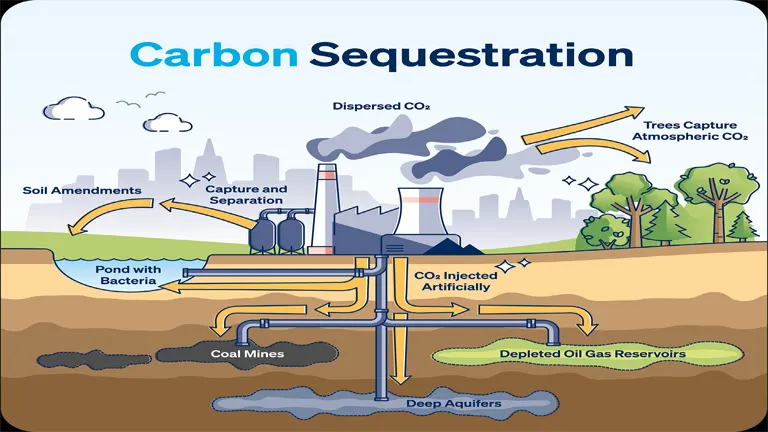

Carbon Sequestration

Forests play a vital role in combating climate change by absorbing carbon dioxide from the atmosphere. By investing in forestry, individuals directly support carbon sequestration efforts, which help reduce greenhouse gas concentrations.

This, in turn, contributes significantly to the fight against global warming. Forestry investments not only offer financial returns but also promote environmental sustainability. As a result, they provide a means to positively impact the planet’s health while building wealth.

Biodiversity Preservation

Investing in Forestry practices is essential for preserving biodiversity by maintaining habitats for a wide range of species. These practices ensure ecological balance, which is crucial for the health of ecosystems. By safeguarding habitats, sustainable forestry supports ongoing conservation efforts and protects wildlife.

This approach not only benefits the environment but also contributes to the resilience of forest ecosystems. As a result, sustainable forestry practices are integral to both biodiversity preservation and ecological stability.

Social Benefits of Forestry Investments

Forestry investments offer a myriad of social benefits, contributing significantly to the well-being and development of communities. These investments go beyond financial returns, providing substantial positive impacts on local economies, infrastructure, and social structures.

- Community Development: Investing in Forestry can stimulate local economies by creating jobs and supporting community development. This can lead to improved infrastructure, education, and healthcare in rural areas.

- Job Creation: Investing in the Forestry sector provides numerous employment opportunities in planting, managing, and harvesting forests. These jobs are vital for the economic well-being of many communities.

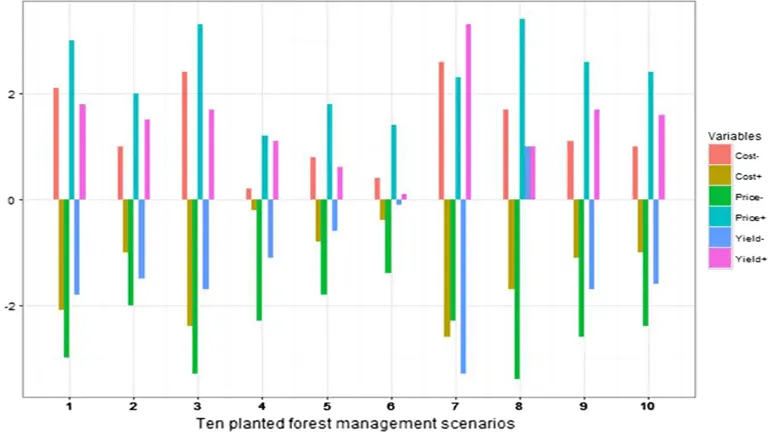

Risk Factors in Forestry Investments

- Market Risks: Timber prices can be volatile due to market demand, trade policies, and competition from alternative materials. Investors must be aware of these fluctuations and plan accordingly.

- Environmental Risks: Invest in Forestry is susceptible to environmental risks such as wildfires, pests, and diseases. These factors can significantly impact forest health and profitability.

Mitigating Risks in Forestry Investments

- Diversification Strategies: Diversifying Invest in Forestry across different regions and tree species can reduce risk. This strategy helps mitigate the impact of local market and environmental issues.

- Insurance Options: Insurance policies can protect Invest in Forestry against risks like fire, storm damage, and pest infestations. This provides financial security and peace of mind for investors.

- Initial Steps: Begin by researching the Invest in Forestry landscape, understanding the market dynamics, and identifying potential opportunities. Consult with forestry experts to gain insights and guidance.

Choosing the Right Type of Forestry Investment

Select an investment type that aligns with your financial goals, risk tolerance, and involvement level. Consider options such as direct ownership, forestry funds, or shares in forestry companies.

- Direct ownership involves purchasing and managing a piece of timberland yourself. This option provides the highest level of control over your investment, allowing you to make decisions about forest management practices, harvest schedules, and land use. It can be highly rewarding, especially if you are knowledgeable about forestry or willing to work with forestry management professionals. However, direct ownership also carries the highest level of risk and requires a significant time commitment and investment in management and maintenance.

- Forestry funds are collective investment vehicles that pool money from multiple investors to buy and manage large tracts of forest land. Investing in a forestry fund provides diversification benefits, as these funds typically invest in a variety of forest properties across different regions. This option allows investors to benefit from the expertise of professional forestry managers without the hands-on responsibility of direct ownership. Forestry funds can offer a balanced mix of risk and return, making them suitable for investors with moderate risk tolerance.

Financial Planning for Forestry Investments

- Budgeting: Careful budgeting is essential for successful Invest in Forestry. Factor in costs such as land acquisition, tree planting, management, and insurance to ensure a clear financial plan.

- Expected Returns: Estimate the potential returns from timber sales, land appreciation, and other revenue streams. This helps set realistic expectations and informs investment decisions.

Case Studies of Successful Forestry Investments

- Real-life Examples: Examining successful Invest in Forestry provides valuable insights. Case studies highlight strategies, challenges, and outcomes, offering lessons for prospective investors.

- Lessons Learned: Analyzing past investments reveals key takeaways that can guide future forestry investment decisions. Learn from others’ experiences to enhance your investment approach.

- Financial Returns: Green Wood has consistently delivered competitive returns to investors, averaging annual returns of 8-12%.

- Environmental Impact: The company’s sustainable practices have contributed to carbon sequestration, biodiversity conservation, and soil health improvement.

- Social Benefits: Green Wood has created jobs and supported local communities through various development projects.

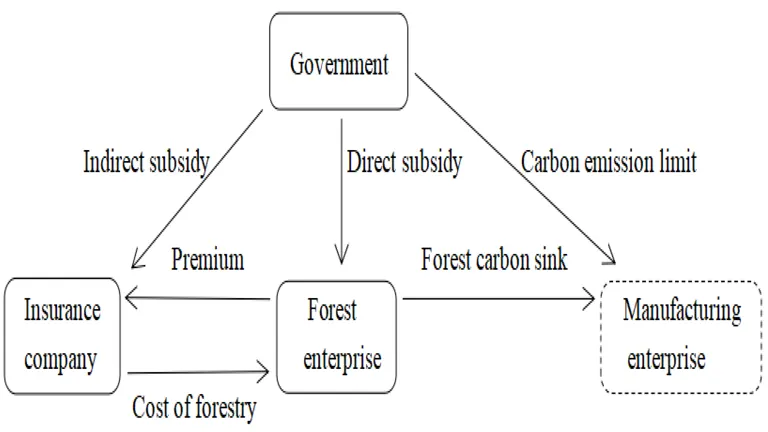

Government Policies and Support for Forestry Investments

Government policies and support play a crucial role in promoting and sustaining forestry investments. Various incentives, grants, and subsidies are available to encourage sustainable forestry practices and enhance the economic viability of these investments. Here are some key aspects of government involvement in forestry investments:

- Incentives: Many governments offer incentives such as tax breaks, grants, and subsidies to encourage investing in Forestry. These can significantly enhance the financial viability of your investment.

- Grants and Subsidies: Explore available grants and subsidies for forestry projects. These funds can offset initial costs and support sustainable forest management practices.

Technological Innovations in Forestry

- Advancements in Forestry Management: Technological innovations, such as remote sensing and data analytics, are revolutionizing forestry management. These tools improve efficiency, reduce costs, and enhance decision-making.

- Impact of Technology on Forestry Investments: Technology is transforming forestry investments by providing better data, improving forest health monitoring, and optimizing resource management. This leads to higher returns and sustainable practices.

Global Trends in Forestry Investments

Current Trends

Stay informed about current trends in the forestry sector, such as increasing demand for sustainable wood products and the rise of carbon offset markets. Understanding these trends helps identify profitable investment opportunities.

Future Projections

Anticipate future developments in forestry investments, including technological advancements, regulatory changes, and shifting market dynamics. These projections guide long-term investment strategies.

Comparing Forestry Investments with Other Asset Classes

Forestry vs. Real Estate

Forestry investments often provide more stable returns compared to real estate, which can be affected by market cycles. Additionally, forestry offers environmental and social benefits that real estate does not.

Forestry vs. Stock Market

Unlike the stock market, which can be highly volatile, forestry investments offer long-term stability. Trees grow regardless of market conditions, providing a consistent income stream.

Sustainable Forestry Practices

- Eco-friendly Management: Adopt eco-friendly forestry practices to ensure sustainability. This includes selective logging, reforestation, and maintaining ecological balance.

- Certifications and Standards: Seek certifications such as FSC (Forest Stewardship Council) to validate sustainable practices. These standards assure investors of responsible forest management.

Tax Implications of Forestry Investments

- Tax Benefit: Invest in Forestry frequently offers substantial tax benefits, including deductions for expenses related to land improvements and conservation initiatives. These tax incentives can significantly reduce the overall cost of managing and maintaining forested land. By taking advantage of these financial benefits, investors can enhance their overall returns and profitability. It is crucial for investors to understand the specific tax advantages available in their region to maximize their investment potential. Properly leveraging these tax benefits can lead to more favorable financial outcomes and support sustainable forestry practices.

- Obligations: Be aware of the tax obligations associated with investing in Forestry, such as income from timber sales and property taxes. These obligations can impact the overall profitability of your investment if not managed properly. Engaging in proper tax planning is essential to ensure compliance with all relevant tax laws and regulations. Effective tax planning can also help optimize financial efficiency, potentially reducing the amount of taxes owed. By staying informed and proactive about tax matters, investors can safeguard their returns and maintain the financial health of their forestry investments.

Conclusion

Investing in forestry is an attractive choice for individuals looking to achieve a combination of financial returns, environmental sustainability, and positive social impact. By delving into the different facets of forestry investments, including the economic advantages and potential risks, investors can make well-informed decisions. This comprehensive understanding not only enhances financial outcomes but also ensures that investments support environmental stewardship and community development. As a result, forestry investments contribute to a more sustainable future. Embracing this approach allows investors to grow their wealth while actively participating in the preservation and betterment of the planet.

FAQs

- What are the main benefits of investing in forestry? Invest in Forestry offers financial returns, environmental benefits like carbon sequestration, and social advantages such as community development and job creation.

- How do I start investing in forestry? Begin by researching the market, consulting experts, and choosing the right type of investment. Consider direct ownership, forestry funds, or shares in forestry companies.

- What are the risks associated with forestry investments? Invest in Forestry carry risks like market volatility and environmental threats (wildfires, pests). Mitigate these by diversifying investments and obtaining insurance.

- How can technology improve forestry investments? Technological advancements enhance forestry management through better data collection, monitoring, and resource optimization, leading to increased efficiency and returns.

- Are there tax benefits for forestry investments? Yes, Invest in Forestry often qualify for tax deductions related to land improvements and conservation efforts, enhancing overall returns.

- What is the impact of forestry investments on the environment? Invest in Forestry contribute to environmental sustainability by sequestering carbon, preserving biodiversity, and promoting eco-friendly practices.

- What is the difference between direct ownership and forestry funds? Direct ownership involves purchasing and managing a piece of timberland yourself, providing maximum control over forestry practices and decisions. However, it requires significant time, effort, and expertise. Forestry funds, on the other hand, pool money from multiple investors to buy and manage large tracts of forest land, offering diversification and professional management with less hands-on involvement from individual investors.

- How do forestry investments contribute to carbon sequestration? Forests absorb carbon dioxide from the atmosphere through photosynthesis, storing carbon in trees, soil, and vegetation. By investing in forestry, you support the growth and maintenance of forests, enhancing their capacity to sequester carbon and mitigate climate change. Some forestry investments also generate carbon credits, which can be sold in carbon markets for additional revenue.

- What are the social benefits of forestry investments for local communities? Forestry investments create employment opportunities, support community development, and improve local infrastructure such as roads, schools, and healthcare facilities. They also promote sustainable practices that protect cultural heritage and enhance the quality of life for residents. By involving local communities in forestry projects, these investments foster social cohesion and economic stability.

- Can forestry investments be considered sustainable? Yes, forestry investments can be sustainable when they adhere to eco-friendly management practices. Sustainable forestry involves selective logging, reforestation, maintaining ecological balance, and obtaining certifications such as FSC (Forest Stewardship Council). These practices ensure that forests are managed responsibly, preserving their health and productivity for future generations.

Investing in forestry offers a compelling mix of financial returns, environmental stewardship, and social impact. By understanding the various aspects of forestry investments, from economic benefits to risk mitigation, you can make informed decisions and contribute to a sustainable future. Whether you choose direct ownership, forestry funds, or shares in forestry companies, forestry investments provide a unique opportunity to grow wealth while benefiting the planet and communities.

James Wilson

Forestry AuthorJames Wilson has over 15 years of experience in forestry economics, specializing in sustainable practices, investment opportunities, and financial management. He has contributed to notable publications like "Forestry Today" and "EcoFinance Journal" and is known for providing practical and insightful advice. With a degree in Environmental Economics, James stays updated through continuous learning and active participation in industry discussions. Outside work, he enjoys hiking and nature photography, bringing a well-rounded perspective to his professional role.

Leave your comment