Investing in Trees, Investing in Tomorrow

- February 11, 2025

- 0 comment

Investing in Trees, Investing in Tomorrow presents a unique opportunity to blend financial gain with sustainable environmental practices. As the world grapples with the challenges of climate change and resource depletion, trees offer a multifaceted solution. They play a crucial role in stabilizing the environment, enhancing biodiversity, and providing economic benefits through timber and non-timber products.

The importance of sustainable investments is becoming increasingly clear as traditional sectors face growing pressure from ecological and social accountability. Trees, with their potential to absorb carbon dioxide and enrich ecosystems, stand as a beacon of hope. Moreover, the economic potential of tree-related investments is substantial, offering returns through diverse avenues such as timber, carbon credits, and sustainable land management practices.

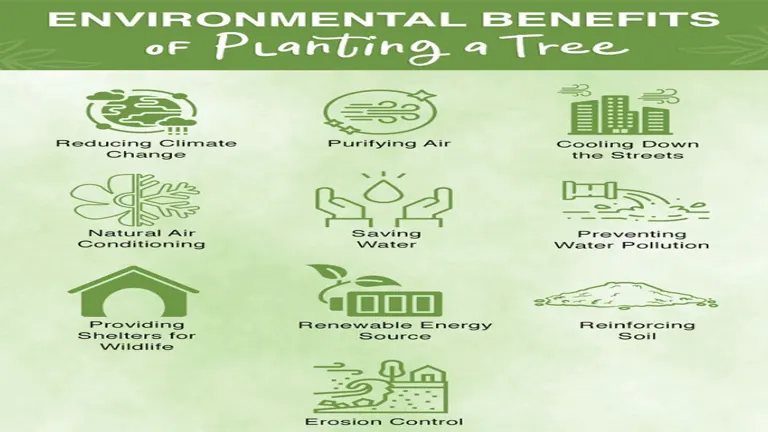

Environmental Benefits of Investing in Trees

Investing in trees is not just about economic returns; it has profound environmental implications. Trees are vital in carbon sequestration, helping to mitigate climate change by absorbing carbon dioxide from the atmosphere. This process significantly reduces the greenhouse effect, making tree plantations a critical component in combating global warming.

Beyond carbon sequestration, trees enhance biodiversity and wildlife habitats. They provide shelter and food for countless species, fostering a balanced ecosystem. Additionally, trees play a pivotal role in soil conservation and water management. Their roots stabilize the soil, reducing erosion, while their canopies intercept rainfall, improving water infiltration and reducing runoff.

Economic Opportunities in Tree Plantations

Tree plantations offer a wealth of economic opportunities. Timber production remains a cornerstone, with global demand driven by construction, furniture, and paper industries. Market trends indicate a growing preference for sustainably sourced timber, providing an edge for environmentally conscious investors.

Beyond timber, non-timber forest products (NTFPs) present lucrative prospects. These include fruits, nuts, resins, and medicinal plants, which can be harvested sustainably, providing continuous income streams. Furthermore, agroforestry—a land management system combining trees with crops or livestock—enhances productivity and soil health, offering a sustainable alternative to traditional agriculture.

Social Impact of Investing in Trees

The social impact of tree investments extends beyond environmental and economic benefits. By creating jobs and fostering community development, tree plantations can uplift rural economies. Employment opportunities in planting, maintenance, and harvesting provide livelihoods for many, reducing poverty and promoting social stability.

Education and skill-building initiatives often accompany tree investment projects, equipping local populations with the knowledge and expertise to manage resources sustainably. Moreover, investing in trees helps preserve cultural and ecological heritage, promoting a deeper connection between communities and their natural environment.

Types of Tree Investment Models

Investors can choose from various tree investment models, each with distinct advantages and considerations. Direct ownership involves purchasing and managing forest land, offering control but requiring significant expertise and capital. Alternatively, pooled investments, such as forestry investment funds, allow multiple investors to share ownership and risk, providing diversification and professional management.

Green bonds and carbon credits represent innovative approaches, enabling investors to support environmental projects while earning financial returns. These instruments facilitate investment in carbon offset projects, promoting sustainable practices globally. Community forestry and co-investment schemes emphasize collaboration with local populations, ensuring equitable distribution of benefits and fostering long-term sustainability.

Evaluating Tree Investment Risks

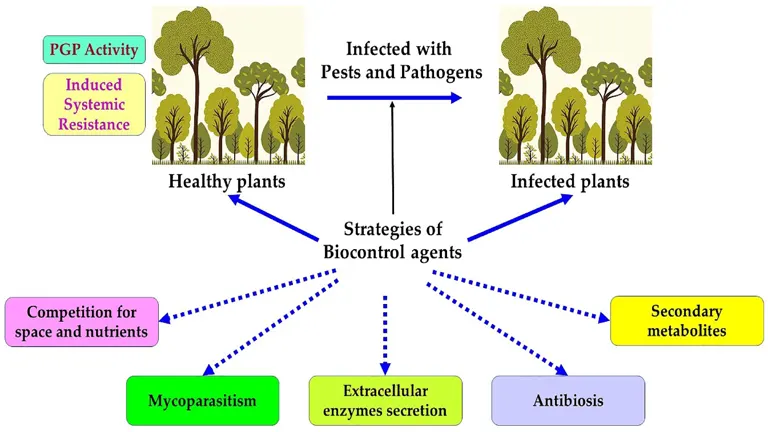

Like any investment, tree-related ventures come with risks. Environmental and climate-related risks, such as pests, diseases, and natural disasters, can affect the health and productivity of plantations. Investors must consider these factors and implement adaptive management strategies to mitigate potential impacts.

Market volatility and economic uncertainties pose additional challenges. Fluctuating timber prices and changing demand for forest products can influence returns, making it essential for investors to stay informed about industry trends and market dynamics. Legal and regulatory considerations, including land tenure and environmental regulations, also play a crucial role in shaping investment outcomes.

Steps to Start Investing in Trees

Starting your journey in tree investments requires careful planning and consideration. Begin by assessing your investment goals and risk tolerance, ensuring alignment with your financial and ethical objectives. Researching potential projects and partners is crucial, as reputable entities with a track record of success are more likely to deliver positive outcomes.

Monitoring and reporting on investment performance is essential for transparency and accountability. Regular assessments help identify areas for improvement and ensure that investments align with both financial and environmental goals.

Future Outlook

The future of tree investments looks promising, with technology playing an increasingly important role. Remote sensing, drones, and data analytics enable precise monitoring of tree health and growth, enhancing decision-making and resource management.

Policy developments and international cooperation are also driving the sector forward. Global agreements on climate change and sustainable development underscore the importance of forests, creating incentives for investment in tree-related projects. The long-term benefits of such investments extend beyond financial returns, contributing to a healthier planet for future generations.

Investing in Trees, Investing in Tomorrow

Incorporating tree investments into personal and institutional portfolios offers a unique opportunity to balance financial returns with positive environmental and social impacts. By investing in trees, individuals and organizations can contribute to building a sustainable future, fostering a world where economic growth and ecological preservation go hand in hand.

Conclusion

Investing in trees is a forward-looking strategy that not only promises financial returns but also fosters sustainable development across multiple dimensions. This type of investment offers significant environmental benefits by mitigating climate change, enhancing biodiversity, and promoting healthier ecosystems. Economically, tree investments can yield returns through timber, non-timber products, and carbon credits, making them a viable addition to diversified portfolios. Socially, these investments can contribute to job creation, community development, and the preservation of cultural heritage. By incorporating tree investments into financial strategies, individuals and organizations can play a crucial role in building a resilient and prosperous world for future generations.

FAQs

- What are the main benefits of investing in trees? Investing in trees offers numerous benefits, including carbon sequestration, biodiversity enhancement, soil conservation, and economic opportunities through timber and non-timber products. Additionally, it fosters community development and supports sustainable land management practices.

- How can I start investing in trees? To start investing in trees, assess your investment goals and risk tolerance, research potential projects and partners, and monitor investment performance regularly. Consider various investment models, such as direct ownership, pooled investments, and green bonds, to find the best fit for your objectives.

- What are the risks associated with tree investments? Tree investments come with risks such as environmental and climate-related challenges, market volatility, and legal considerations. To mitigate these risks, investors should stay informed about industry trends, implement adaptive management strategies, and collaborate with reputable partners.

- How do tree investments contribute to climate change mitigation? Trees absorb carbon dioxide from the atmosphere through carbon sequestration, reducing the greenhouse effect and helping mitigate climate change. Additionally, they provide habitats for biodiversity and support ecosystem services that enhance resilience to climate impacts.

- What are non-timber forest products (NTFPs)? Non-timber forest products (NTFPs) include a variety of resources such as fruits, nuts, resins, medicinal plants, and fibers that can be sustainably harvested from forests. These products offer alternative income streams and contribute to the economic viability of tree investments.

- Can technology improve tree investment outcomes? Yes, technology plays a crucial role in improving tree investment outcomes. Tools such as remote sensing, drones, and data analytics enable precise monitoring and management of plantations, enhancing decision-making and resource efficiency.

- What are the main benefits of investing in trees? Investing in trees offers numerous benefits, including carbon sequestration, biodiversity enhancement, soil conservation, and economic opportunities through timber and non-timber products. Additionally, it fosters community development and supports sustainable land management practices.

- How can I start investing in trees? To start investing in trees, assess your investment goals and risk tolerance, research potential projects and partners, and monitor investment performance regularly. Consider various investment models, such as direct ownership, pooled investments, and green bonds, to find the best fit for your objectives.

- What are the risks associated with tree investments? Tree investments come with risks such as environmental and climate-related challenges, market volatility, and legal considerations. To mitigate these risks, investors should stay informed about industry trends, implement adaptive management strategies, and collaborate with reputable partners.

- How do tree investments contribute to climate change mitigation? Trees absorb carbon dioxide from the atmosphere through carbon sequestration, reducing the greenhouse effect and helping mitigate climate change. Additionally, they provide habitats for biodiversity and support ecosystem services that enhance resilience to climate impacts.

Investing in trees is not just a financial decision—it’s a commitment to shaping a sustainable future. By integrating tree investments into personal and institutional portfolios, we can ensure environmental stewardship, economic growth, and social equity. As the world seeks solutions to climate change and biodiversity loss, trees offer a powerful tool for positive change. By choosing to invest in trees today, you are playing a crucial role in preserving our planet for future generations. Embrace the opportunity to make a difference by investing in trees and, in turn, investing in a brighter tomorrow.

Kristine Moore

Forestry AuthorI'm Kristine Moore, a seasoned garden landscaping professional with over 30 years of experience. My extensive career has been dedicated to transforming outdoor spaces into stunning, sustainable landscapes. With a deep understanding of horticulture, design principles, and environmental stewardship, I have become a respected figure in the field, known for creating harmonious, visually appealing, and eco-friendly gardens. My commitment to excellence and continuous learning in landscaping trends and techniques has solidified my reputation as an expert in garden design and implementation.

Leave your comment