Forestry Fortunes: Exploring Investment Potential and Economic Impact

- August 16, 2024

- 0 comment

Investment potential and economic impact represent a unique opportunity for investors seeking to combine financial returns with environmental and social benefits. As the global demand for sustainable resources grows, the forestry sector has emerged as a key player in providing renewable materials, sequestering carbon, and supporting biodiversity.

These investments enable investors to align their portfolios with environmental goals and take part in the transition to a greener economy. By exploring the complex nature of forestry investments, this article provides insights into their potential benefits and the substantial economic effects they can generate on both local and global levels. Through this analysis, readers will gain a deeper understanding of how forestry investments contribute to sustainable development and the broader economic landscape.

Understanding Investment Potential and Economic Impact

Investment potential and economic impact involve the acquisition and management of forest land and timber resources with the goal of generating financial returns. These investments can take various forms, including direct ownership of timberland, investments in timber funds, and participation in real estate investment trusts (REITs) focused on forestry assets.

Types of Forestry Investments

- Direct Ownership: Involves purchasing and managing forest land, allowing investors to have full control over their investment and management decisions. This approach requires significant capital and expertise in forest management.

- Timber Funds: These are managed investment funds that pool capital from multiple investors to acquire and manage forestry assets. Timber funds offer diversification and professional management, making them an attractive option for institutional investors.

- Real Estate Investment Trusts (REITs): REITs focused on forestry assets provide a way for investors to gain exposure to the forestry sector without directly owning land. These publicly traded companies own and manage income-generating forestry properties.

Economic Impact of Forestry

Investment potential and economic impact are a vital component of the global economy, significantly contributing to employment, trade, and economic growth. The impact of the forestry sector goes beyond the immediate benefits of timber production, influencing a diverse range of industries such as construction, paper manufacturing, and renewable energy.

These investments not only drive economic development in urban areas but also play a crucial role in supporting rural communities by providing jobs and infrastructure. By fostering trade relationships and stimulating local economies, forestry investments enhance economic resilience and stability. Additionally, they create opportunities for sustainable development, ensuring that economic benefits are balanced with environmental responsibility.

- Contribution to Local and Global Economies: Forestry is a critical driver of economic development, particularly in rural areas where forest resources are abundant. The industry generates billions of dollars in revenue each year, supporting a wide range of sectors, including construction, paper production, and renewable energy.

- Employment Opportunities: The forestry sector provides employment for millions of people worldwide, from investment potential and economic impact management and harvesting to processing and manufacturing. This employment not only supports local economies but also contributes to poverty alleviation and social development in many regions.

- Impact on Rural Development: Investment potential and economic impact can have a transformative impact on rural communities, providing infrastructure development, educational opportunities, and improved livelihoods. By investing in sustainable forestry practices, investors can help drive positive change and promote long-term economic stability in these areas.

Environmental Benefits of Forestry Investments

Forestry investments offer numerous environmental benefits, making them an attractive option for investors seeking to align their portfolios with sustainability goals. These benefits include carbon sequestration, biodiversity conservation, and sustainable land management practices.

- Carbon Sequestration and Climate Change Mitigation: Forests play a crucial role in mitigating climate change by absorbing and storing carbon dioxide from the atmosphere. Forestry investments contribute to carbon sequestration efforts, helping to offset emissions and support global climate targets. Investors can also participate in carbon offset markets, monetizing the carbon sequestration potential of their forestry assets.

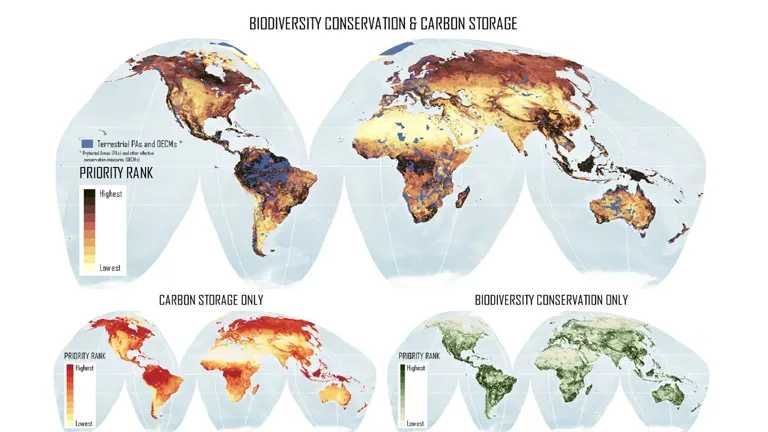

- Biodiversity Conservation: Forests are home to a vast array of plant and animal species, making them essential for biodiversity conservation. Sustainable forestry practices can help preserve these ecosystems, protecting endangered species and maintaining ecological balance. By investing in forestry, investors can contribute to the preservation of critical habitats and the protection of biodiversity.

- Sustainable Land Management Practices: Forestry investments encourage the adoption of sustainable land management practices, promoting responsible resource use and minimizing environmental degradation. These practices include reforestation, selective logging, and maintaining natural habitats, ensuring the long-term health and productivity of forest ecosystems.

Challenges in Forestry Investments

While forestry investments offer significant potential, they also present a range of challenges that investors must navigate to achieve successful outcomes.

- Environmental Risks: Forestry investments are exposed to various environmental risks, including natural disasters such as wildfires, storms, and pests. These events can have a devastating impact on forest resources, affecting both the financial returns and environmental benefits of the investment.

- Market Volatility: The forestry sector is subject to market volatility, influenced by factors such as changes in timber prices, demand fluctuations, and economic cycles. Investors must be prepared to manage these risks through diversification and strategic planning.

- Regulatory Hurdles: Forestry investments are often subject to complex regulatory frameworks, including land use restrictions, environmental regulations, and taxation policies. Navigating these regulations requires careful planning and compliance to ensure the success and sustainability of the investment.

Analyzing the Financial Returns

Forestry investments can offer competitive financial returns, particularly when compared to traditional asset classes. Understanding the factors that influence profitability is key to maximizing returns and minimizing risks.

Return on Investment (ROI) Comparisons

Forestry investments have historically delivered attractive returns, with average annual returns ranging from 6% to 8%. These returns are comparable to other alternative investments, such as real estate and private equity, making forestry an appealing option for investors seeking diversification.

Factors Influencing Profitability

Several factors influence the profitability of forestry investments, including timber growth rates, market demand, and operational efficiency. Investors must carefully assess these factors and implement effective management strategies to optimize returns and achieve their investment objectives.

Global Trends in Forestry Investments

The forestry sector is experiencing significant changes driven by emerging markets, technological advancements, and evolving policy landscapes. Understanding these trends is essential for investors looking to capitalize on new opportunities.

Emerging Markets

Emerging markets in Asia, Africa, and Latin America offer significant potential for forestry investments, driven by increasing demand for timber and wood products. These regions present opportunities for growth and expansion, although they also come with unique challenges and risks.

Technological Advancements

Advancements in technology are transforming the forestry sector, improving operational efficiency, and enabling more sustainable practices. Innovations such as remote sensing, precision forestry, and data analytics are enhancing decision-making and resource management, creating new opportunities for investors.

Policy Changes

Changes in government policies and regulations are shaping the future of forestry investments, with a growing emphasis on sustainability and responsible resource management. Investors must stay informed of policy developments to navigate regulatory challenges and capitalize on new incentives and opportunities.

Case Studies of Successful Forestry Investments

Examining successful forestry investments provides valuable insights and lessons for investors seeking to enter or expand their presence in the sector.

Notable Examples

Several notable examples of successful forestry investments highlight the potential of the sector. Companies such as Weyerhaeuser and Rayonier have demonstrated strong performance and profitability, driven by strategic management and sustainable practices.

Lessons Learned

Key lessons from successful forestry investments include the importance of diversification, effective risk management, and a focus on sustainability. Investors can apply these insights to enhance their strategies and achieve successful outcomes in the forestry sector.

Strategic Approaches to Forestry Investment

Adopting strategic approaches to forestry investment is essential for managing risks and maximizing returns. This section explores various strategies that investors can employ to achieve their objectives.

Risk Management Strategies

Effective risk management is critical for forestry investments, given the inherent risks and uncertainties in the sector. Strategies such as insurance, diversification, and contingency planning can help investors mitigate risks and protect their investments.

Diversification in Forestry Portfolios

Diversification is a key strategy for reducing risk and enhancing returns in forestry investments. By investing in a mix of geographic regions, tree species, and investment vehicles, investors can spread risk and capture opportunities across different market segments.

Conclusion

Investment potential and economic impact offer a unique blend of financial returns, environmental benefits, and social impacts, making them an attractive option for investors seeking sustainable and responsible investment opportunities. By understanding the potential and challenges of forestry investments, investors can make informed decisions and contribute to a more sustainable future.

FAQs

- Why is forestry a viable investment? Investment potential and economic impact is a viable investment due to its potential for competitive financial returns, environmental benefits, and positive social impacts. The sector offers diversification, sustainability, and resilience, making it an attractive option for investors seeking to balance profit with purpose.

- What are the risks associated with forestry investments? Investment potential and economic impact are subject to environmental risks, market volatility, and regulatory challenges. Investors must navigate these risks through strategic planning, risk management, and compliance with industry standards.

- How do forestry investments contribute to environmental sustainability? Investment potential and economic impact contribute to environmental sustainability by promoting carbon sequestration, biodiversity conservation, and sustainable land management practices. These investments support climate change mitigation and the preservation of critical ecosystems.

- Can individuals invest in forestry, or is it only for large corporations? Individuals can invest in forestry through various investment vehicles, such as REITs, timber funds, and direct ownership. While some options require significant capital, others provide accessible opportunities for individual investors to participate in the sector.

- What is the expected ROI for forestry investments? The expected ROI for investment potential and economic impact varies depending on factors such as timber growth rates, market conditions, and management strategies. Historically, forestry investments have delivered average annual returns of 6% to 8%, comparable to other alternative investments.

- How does climate change affect forestry investments? Climate change poses both risks and opportunities for investment potential and economic impact. While changing weather patterns can impact forest health and productivity, increased demand for carbon sequestration and sustainable resources presents new opportunities for growth and innovation.

- How does forestry investment help in climate change mitigation? Investment potential and economic impact help mitigate climate change by promoting practices that increase carbon sequestration, such as reforestation and sustainable land management. Trees absorb carbon dioxide from the atmosphere, reducing greenhouse gas levels and contributing to climate change mitigation efforts. By investing in forestry, individuals and companies can participate in carbon offset programs and help achieve global climate goals.

- What role do government policies play in forestry investments? Government policies play a crucial role in shaping the investment potential and economic impact landscape. Policies and regulations related to land use, environmental protection, and taxation can impact the profitability and sustainability of forestry projects. Additionally, government incentives such as grants, subsidies, and tax benefits can encourage investment in sustainable forestry practices and innovation within the sector.

- Is forestry investment considered a long-term commitment? Yes, investment potential and economic impact is generally considered a long-term commitment due to the time it takes for trees to mature and yield returns. Depending on the tree species and management practices, it can take anywhere from 10 to 30 years for investors to realize significant financial returns. However, the long-term nature of investment potential and economic impact also provides stability and resilience against short-term market fluctuations.

- What are the environmental risks associated with forestry investments? Environmental risks associated with forestry investments include natural disasters such as wildfires, storms, and pest infestations. These events can severely damage forest resources and impact both financial returns and environmental benefits. Investors must implement risk management strategies, such as insurance and diversification, to mitigate these risks and protect their investments.

Investment potential and economic impact offer a compelling opportunity for investors seeking to balance financial returns with environmental and social impact. By understanding the complexities of the forestry sector and staying informed about emerging trends and challenges, investors can make strategic decisions that contribute to a sustainable future. With the growing emphasis on responsible resource management and climate change mitigation, forestry investments are poised to play an increasingly important role in the global economy.

James Wilson

Forestry AuthorJames Wilson has over 15 years of experience in forestry economics, specializing in sustainable practices, investment opportunities, and financial management. He has contributed to notable publications like "Forestry Today" and "EcoFinance Journal" and is known for providing practical and insightful advice. With a degree in Environmental Economics, James stays updated through continuous learning and active participation in industry discussions. Outside work, he enjoys hiking and nature photography, bringing a well-rounded perspective to his professional role.

Leave your comment