Evaluating Forestry Investment Risks and Rewards

- August 8, 2024

- 0 comment

Evaluating forestry investment risks and rewards reveals a distinctive opportunity to achieve both ecological benefits and financial returns. Investing in forestry not only promotes sustainability but also offers the potential for substantial economic gains.

By putting money into forest management and development, investors can support environmental conservation efforts. Additionally, forestry investments can provide long-term financial stability and diversification for portfolios. This dual advantage makes forestry an attractive option for those seeking to balance profitability with environmental responsibility.

What is Evaluating forestry investment risks and rewards?

Evaluating forestry investments involves allocating capital to various forest-related activities. This can include purchasing timberland, investing in agroforestry systems, or funding reforestation projects. The main objective is to generate revenue through the growth, management, and sale of timber and other forest products. By investing in these activities, investors aim to achieve financial returns while contributing to environmental sustainability. Additionally, these investments often support biodiversity and help mitigate climate change through carbon sequestration.

Types of Forestry Investments

Timberland

Investing directly in timberland involves purchasing forested land with the intent of managing and harvesting timber. This type of investment offers control over the asset and potential tax benefits.

Agroforestry

Agroforestry combines agriculture and forestry to create more sustainable land-use systems. Investors in agroforestry benefit from diversified revenue streams, including crops, livestock, and timber.

Reforestation Projects

Investing in reforestation projects supports the planting of trees on deforested land. These projects contribute to environmental restoration and can generate carbon credits, providing an additional revenue source.

Economic Factors Affecting Forestry Investments

Economic factors, including market demand, pricing trends, and economic cycles, play a crucial role in the performance of forestry investments. During economic downturns, timber prices may decline, impacting short-term revenues.

However, the long-term nature of forestry investments can help mitigate these risks, as timber can often be held until market conditions improve. Additionally, the diverse applications of timber and forest products can provide a buffer against economic fluctuations. Understanding these economic factors is essential for making informed forestry investment decisions.

Environmental Considerations

Forestry investments are intrinsically linked to environmental sustainability. Implementing responsible forestry practices helps to maintain and enhance ecosystem health, promoting biodiversity and preserving habitats for various species.

These practices also support carbon sequestration efforts, which are crucial in mitigating climate change by capturing and storing atmospheric carbon dioxide. Moreover, sustainable forestry ensures that forest resources are managed in a way that meets present needs without compromising the ability of future generations to meet theirs. Thus, investing in forestry not only offers financial returns but also contributes to the long-term health of our planet.

Geopolitical and Regulatory Factors

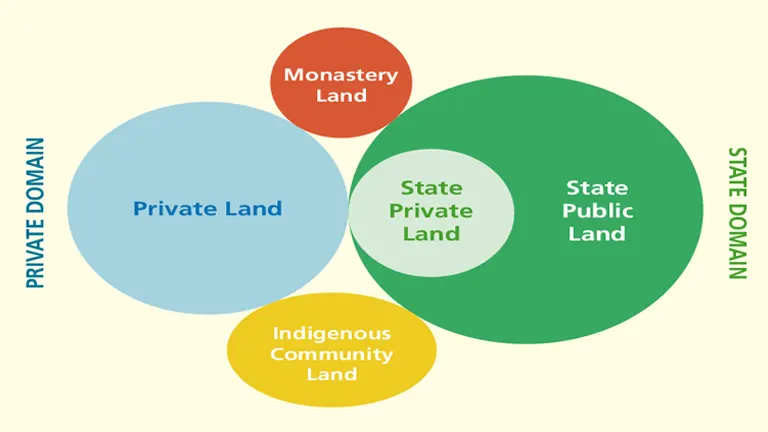

Geopolitical and regulatory factors, such as land ownership laws and government policies, can significantly impact the viability and profitability of forestry investments. These factors can influence everything from the ability to acquire land to the costs of compliance and potential returns.

Changes in regulations, political stability, and international trade policies can also affect market dynamics and investment outcomes. Therefore, understanding and navigating these geopolitical and regulatory landscapes is crucial for making successful forest investments. Investors need to stay informed and adaptable to mitigate risks and maximize returns in this complex environment.

Market Demand for Timber and Forest Products

The market demand for timber and forest products is shaped by various factors, including trends in the construction industry, which often drives the need for lumber and building materials. Additionally, the demand for paper and packaging materials plays a significant role, especially as e-commerce continues to expand. The growth of bioenergy markets also contributes to increased demand, as more industries and consumers seek sustainable and renewable energy sources. These factors collectively impact the overall market dynamics and investment opportunities within the forestry sector. Understanding these demand drivers is essential for investors looking to capitalize on forest investments.

Investment Strategies in Forestry

Direct Ownership

Direct ownership of timberland allows investors to have control over the management and harvesting of timber, providing potential tax advantages and long-term appreciation.

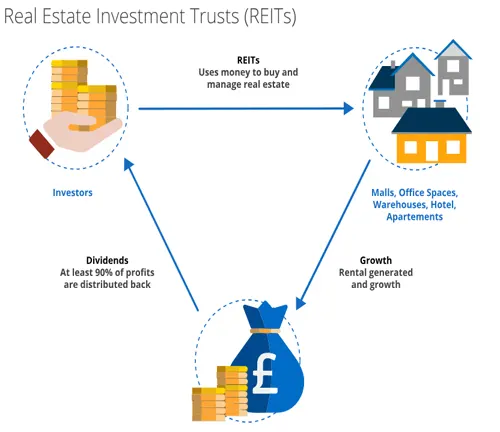

REITs

Real Estate Investment Trusts (REITs) offer a way to invest in timberland without direct ownership. These trusts provide liquidity and diversification benefits.

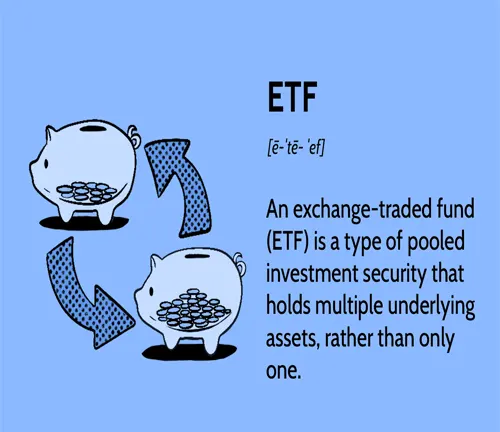

ETFs

Exchange-traded funds (ETFs) focusing on forestry investments provide a diversified portfolio of forest-related assets, making it easier for individual investors to gain exposure to the sector.

Risk Management in Forestry Investments

Effective risk management strategies in forestry investments involve several key approaches. Diversification across different geographies and species can help mitigate risks related to regional climate events, pests, and diseases. Obtaining insurance is another crucial strategy, providing financial protection against natural disasters, fire, and other unforeseen events. Understanding and adhering to legal protections related to land ownership and environmental regulations is also vital, as compliance can prevent legal issues and potential fines. Together, these strategies help create a more resilient and secure investment, reducing exposure to various risks while maximizing potential returns.

Financial Metrics for Evaluating Forestry Investments

Key financial metrics for evaluating forestry investments include Return on Investment (ROI), Internal Rate of Return (IRR), and Payback Period. ROI measures the overall profitability of the investment relative to its cost, providing a straightforward indication of financial performance. IRR offers a more nuanced view, considering the time value of money and helping investors understand the annualized rate of return expected from the investment. The Payback Period metric shows how long it will take for the initial investment to be recovered through generated income. Together, these metrics enable investors to assess both the potential profitability and risk associated with forestry investments, ensuring informed decision-making.

Technological Innovations in Forestry

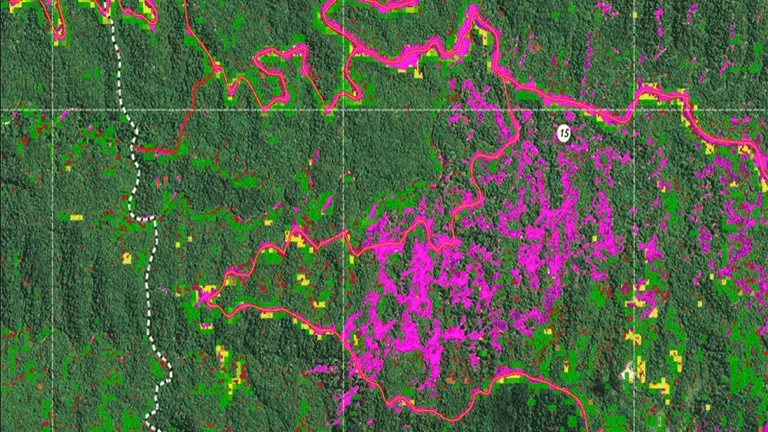

Technological advancements, such as precision forestry, remote sensing, and biotechnology, are revolutionizing the forestry sector. Precision forestry uses data analytics and geospatial technologies to optimize forest management practices, ensuring more efficient and sustainable operations.

Remote sensing technologies, including satellite imagery and drones, allow for real-time monitoring of forest health, growth, and biodiversity, facilitating timely interventions and reducing the need for manual inspections. Biotechnology innovations, such as the development of genetically improved tree species, enhance yield, resilience, and disease resistance. These technologies collectively improve yield, reduce costs, and support sustainable forestry practices, making the sector more efficient and profitable.

Challenges and Pitfalls in Forestry Investments

Common challenges in forestry investments include market volatility, environmental risks, and regulatory changes. Market volatility can impact timber prices and demand, while environmental risks, such as wildfires, pests, and diseases, can threaten forest health and productivity. Regulatory changes can affect land use, logging practices, and environmental compliance costs. To mitigate these risks, investors should engage in careful planning and diversify their investments across different regions and tree species. Staying informed about industry trends and regulatory developments is also crucial, enabling investors to adapt their strategies proactively. This comprehensive approach helps safeguard investments and enhance long-term profitability in the forestry sector.

Impact of Climate Change on Forestry Investments

Climate change presents both risks and opportunities for forestry investments. Changing weather patterns and increased frequency of extreme weather events can adversely affect tree growth, health, and overall forest productivity.

These environmental challenges pose significant risks to forestry investments, potentially leading to increased management costs and reduced yields.

How to Get Started with Forestry Investments

New investors can embark on forestry investments by taking several key steps to ensure informed decision-making. First, conducting thorough research is essential; understanding the market dynamics, types of forestry investments, and associated risks and rewards can provide a solid foundation. Next, visiting potential investment sites allows investors to assess the condition and potential of the forest land firsthand. Consulting with forestry experts is also crucial; their insights can help navigate the complexities of the investment, from legal considerations to sustainable management practices. Additionally, reviewing case studies of successful forestry investments and staying updated on industry trends can further guide new investors in making sound, strategic decisions in the forestry sector.

Conclusion

Forestry investments present an appealing combination of financial returns and environmental benefits. Investors who grasp the associated risks and rewards can make well-informed decisions, promoting both profitability and sustainable forest management. These investments not only generate income but also support ecological conservation efforts. Understanding the complexities of forest investments enables investors to maximize their economic gains while fostering environmental stewardship. This unique blend of financial and ecological advantages makes forestry an attractive investment option.

FAQs

- What are the main benefits of forestry investments? Forest investments provide long-term returns, portfolio diversification, and environmental benefits such as carbon sequestration.

- How does climate change impact forestry investments? Climate change can affect tree growth and health but also presents opportunities for carbon credit generation and sustainable forestry practices.

- What are some common risks in forestry investments? Common risks include market volatility, environmental hazards, and regulatory changes. Diversification and thorough research can help mitigate these risks.

- How can new investors start in forestry investments? New investors should research extensively, visit potential investment sites, and consult with forestry experts to make informed decisions.

- What is the role of technology in forestry investments? Technology enhances forest management through precision forestry, remote sensing, and biotechnology, improving yield and reducing costs.

- Why is sustainability important in forestry investments? Sustainability ensures the long-term health of forests, supports biodiversity, and meets the growing demand for environmentally responsible products.

- How do forestry investments generate revenue? Forest investments generate revenue primarily through the sale of timber and forest products. Additionally, income can be derived from leasing land for recreational purposes, selling carbon credits, and engaging in agroforestry practices that yield diversified agricultural products.

- What is the minimum investment required for forestry investments? The minimum investment required for forest investments varies widely depending on the type and location of the investment. Direct ownership of timberland may require substantial capital, often in the hundreds of thousands of dollars, while investing in forestry REITs or ETFs can be done with significantly smaller amounts, sometimes as low as a few hundred dollars.

- Are forestry investments liquid? Forest investments are generally considered illiquid, especially direct ownership of timberland, as it can take years to sell the land and harvest the timber. However, investing in forestry through REITs or ETFs offers greater liquidity, allowing investors to buy and sell shares more easily on the open market.

- What are the tax implications of forestry investments? The tax implications of forest investments can include capital gains tax on profits from timber sales, potential property taxes on timberland, and tax benefits for qualifying conservation and reforestation activities. It’s important for investors to consult with a tax professional to understand the specific tax treatments and benefits applicable to their investment.

Forestry investments offer a unique opportunity to blend financial returns with environmental stewardship. By understanding the complexities of this market, investors can navigate the risks and capitalize on the rewards, contributing to a sustainable future.

James Wilson

Forestry AuthorJames Wilson has over 15 years of experience in forestry economics, specializing in sustainable practices, investment opportunities, and financial management. He has contributed to notable publications like "Forestry Today" and "EcoFinance Journal" and is known for providing practical and insightful advice. With a degree in Environmental Economics, James stays updated through continuous learning and active participation in industry discussions. Outside work, he enjoys hiking and nature photography, bringing a well-rounded perspective to his professional role.

Leave your comment