Trump Proposes 25% Tariff on Lumber Imports

- February 25, 2025

- 0 comment

The ongoing trade tensions between the United States and its key trade partners have taken another turn, with former President Donald Trump proposing a 25% tariff on lumber and forest products. According to reports from Reuters, Trump has indicated plans to announce these tariffs by April 2, 2025, as part of a broader strategy to protect domestic industries. The move is expected to have far-reaching implications for the construction sector, housing affordability, and international trade relations, particularly with Canada and Mexico.

The United States has long relied on Canadian softwood lumber imports to meet its construction demands, making this proposed tariff a significant policy shift. This is not the first time trade tensions over lumber have surfaced. The U.S. and Canada have engaged in multiple trade disputes regarding softwood lumber, with accusations of unfair subsidies and dumping practices frequently leading to retaliatory measures.

Historically, tariffs on Canadian lumber have been a contentious issue. The Softwood Lumber Agreement (SLA) between the two nations expired in 2015, and since then, periodic trade disputes have led to various countervailing and anti-dumping duties. The new 25% tariff proposal reignites concerns over trade relations and the impact on the housing sector, where lumber plays a crucial role.

The National Association of Home Builders (NAHB) has voiced concerns about the effect of the proposed tariffs, arguing that increased costs on imported lumber could significantly raise construction expenses. The U.S. housing market is already experiencing affordability challenges due to high interest rates and supply chain disruptions. Adding a substantial tariff on lumber imports could further escalate home prices, making it harder for prospective buyers to enter the market.

According to NAHB, lumber prices have historically been sensitive to trade policies. When previous tariffs were imposed on Canadian lumber in 2017, prices surged, adding thousands of dollars to the cost of building a new home. A similar impact is expected if the proposed 25% tariff takes effect, with potential cost increases being passed down to homebuyers and builders struggling to keep projects affordable.

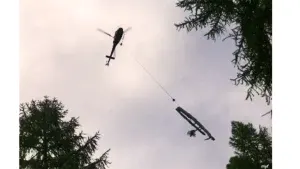

While the intent of the tariff is to bolster the domestic lumber industry by reducing reliance on imports, industry experts remain skeptical about its effectiveness. The Forest Resources Association has warned of potential “supply shocks” due to increased demand for U.S.-sourced lumber. Domestic producers may not be able to scale up production quickly enough to fill the gap left by reduced Canadian imports, leading to market volatility and price fluctuations.

Furthermore, the American lumber industry itself is divided on the issue. While some domestic producers support protectionist policies to safeguard their market share, others warn that increased costs could reduce overall demand, ultimately hurting the industry in the long run. The U.S. Lumber Coalition, which represents domestic sawmills, has expressed cautious support for the tariff proposal but acknowledges that the broader economic implications need to be carefully assessed.

The tariff proposal risks further straining U.S. relations with Canada and Mexico. Both countries have historically opposed U.S. lumber tariffs, arguing that their softwood lumber industries operate fairly under market conditions. If the 25% tariff is imposed, Canada may challenge the move through the World Trade Organization (WTO) or seek retaliation through its own trade policies.

Mexico, another significant trade partner in North American lumber exchanges, may also be affected by the broader protectionist stance. While the primary focus is on Canadian softwood lumber, any disruptions in the North American supply chain could have ripple effects, impacting various industries that rely on timber products, including furniture manufacturing and paper production.

Beyond the housing market, a tariff of this magnitude could have wider economic repercussions. Higher costs for raw materials often translate into increased expenses for consumers, as businesses adjust their pricing strategies to maintain profitability. If construction costs rise significantly, demand for new homes could decrease, slowing down overall economic growth in the housing sector.

Additionally, the impact could extend to secondary markets, including home improvement retailers, furniture makers, and contractors. Many of these businesses rely on affordable lumber to keep costs low for consumers. With a 25% tariff in place, companies may need to explore alternative sourcing strategies or absorb higher costs, potentially leading to layoffs or reduced business expansion.

Trump’s tariff proposal is seen as a move to appeal to American manufacturing and working-class voters ahead of the 2024 presidential election. Protectionist trade policies have been a key part of Trump’s economic strategy in the past, with similar tariffs on steel, aluminum, and Chinese goods implemented during his administration.

Public reaction to the proposal has been mixed. Supporters argue that the tariffs will help revitalize domestic industries, protect American jobs, and reduce reliance on foreign imports. However, critics warn that the policy could backfire by increasing costs for consumers, exacerbating housing affordability issues, and triggering potential retaliatory measures from trade partners.

Economists have also weighed in, with many suggesting that tariffs often lead to unintended consequences. While they may provide short-term relief for specific industries, they can also result in higher prices, reduced trade efficiency, and market distortions that hurt the broader economy.

The proposed 25% tariff on lumber and forest products represents a significant shift in U.S. trade policy, with wide-ranging implications for the housing market, construction industry, and international relations. While proponents argue that the move will protect domestic jobs and industries, critics warn of rising costs and potential retaliatory measures.

As the situation unfolds, businesses, policymakers, and consumers will need to prepare for potential disruptions and economic shifts. Whether the tariff ultimately benefits or harms the U.S. economy remains to be seen, but one thing is certain: the debate over trade policy and protectionism is far from over.

Leave your comment