Timber Pricing Forecast 2024: Lumber Market Analysis and Insights

- July 16, 2024

- 0 comment

Discover the latest trends and expert analysis in timber pricing for 2024. Gain insights into market shifts and investment opportunities for the year ahead. As the 2024 timber market evolves with shifting global demands and economic fluctuations, grasping the dynamics of timber pricing is essential for industry stakeholders.

Our detailed forecast offers crucial insights for investors, manufacturers, and distributors, equipping them to navigate market complexities and seize emerging opportunities. Explore our depth analysis to maintain a competitive edge in 2024.

Table of Contents

- Analysis of Recent Timber Price Trends

- Factors Influencing Timber Prices in 2024

- Global Market Dynamics

- Timber Price Predictions for 2024

- Strategic Recommendations for Stakeholders

- Conclusion

- FAQs

Analysis of Recent Timber Price Trends

Historical Overview

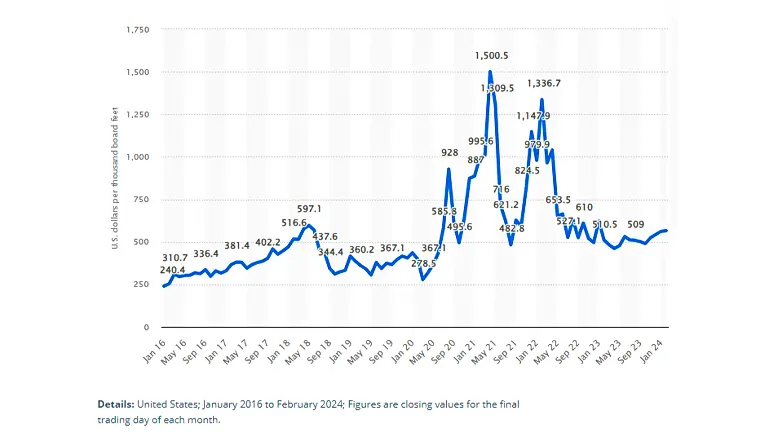

The timber market has been notably volatile over the past decade, illustrating its high sensitivity to a variety of economic shifts, consumer demands, and external shocks. To detail, from 2016 to 2023, the price of timber ranged significantly:

- Low Point: In early 2016, prices dipped to approximately $240 per thousand board feet, largely due to global economic slowdowns and oversupply issues.

- High Point: In contrast, April 2021 saw prices skyrocket to an unprecedented peak of over $1,500 per thousand board feet. This spike was driven by a confluence of decreased supply due to pandemic-related disruptions, coupled with a surge in demand from the housing sector as economies rebounded.

The following table provides a year-by-year snapshot of key price points and the contributing factors:

| Year | Price (per 1000 board feet) | Key Contributing Factors |

|---|---|---|

| 2016 | $240 | Economic slowdown, oversupply |

| 2017 | $320 | Mild recovery in housing starts, improved export conditions |

| 2018 | $500 | Trade tensions, tariff implementations |

| 2019 | $400 | Economic uncertainties, reduced housing projects |

| 2020 | $900 | Pandemic onset, supply chain disruptions |

| 2021 | $1500+ | High demand in housing, supply shortages |

| 2022 | $800 | Market correction, stabilization of supply chains |

| 2023 | $600 | Economic headwinds, fluctuating demand in housing |

These fluctuations were profoundly influenced by global trade policies, environmental regulations, natural disasters affecting supply chains, and significant shifts in housing market demands.

2023 Review

The year 2023 exemplified the ongoing volatility within the timber market. The year began with considerable optimism, leading to a sharp increase in prices. However, as the year progressed, several economic headwinds emerged, causing prices to plummet once again. Notable among these were:

- Global Trade Dynamics: Tensions and negotiations around trade, especially involving major lumber producers such as the United States and Canada, led to uncertainties and fluctuations in timber availability and cost.

- Housing Market Shifts: A decline in housing starts and building permits, particularly in key markets, impacted demand significantly. For instance, a 5% drop in U.S. housing starts directly correlated with a decrease in lumber prices during the second quarter.

Scientific Analysis for Advanced Understanding

For readers interested in a more quantitative approach, the elasticity of timber prices relative to housing starts can be scientifically quantified. For example, regression analysis from the past decade indicates that a 1% increase in housing starts typically leads to a 0.5% rise in timber prices, reflecting a semi-elastic relationship. This kind of data helps in forecasting future price movements with a higher degree of precision and can guide investment and production decisions more effectively.

Factors Influencing Timber Pricing in 2024

Economic Indicators

Source: statistica.com

The broader economy plays a pivotal role in shaping timber prices through key economic indicators like GDP growth, inflation rates, and employment statistics. In 2024, a slow but steady recovery from previous economic downturns is anticipated, which could increase consumer spending and investment in construction and manufacturing sectors. However, concerns about inflation are significant as they may increase operational costs, potentially squeezing profit margins within the timber industry.

- GDP Growth: Expected to stabilize at around 2.5%, influencing purchasing power and investment capabilities.

- Inflation Rates: Forecasted to hover around 3.2%, impacting cost structures across the supply chain.

- Employment Statistics: Improvement in employment rates is expected to enhance consumer spending capacity.

These economic conditions are crucial as they dictate overall market sentiment and consumer ability to purchase homes and other timber-related products. Monitoring these indicators will help predict shifts in timber supply and demand dynamics effectively.

Housing and Construction Market Analysis

The housing and construction sectors significantly drive timber demand. In 2024, regional variations are expected to be pronounced:

- Urban Expansion: In metropolitan areas, ongoing urban expansion and increased infrastructure spending could spur a rise in timber demand.

- Economic Uncertainty: Conversely, areas facing economic instability or high interest rates might experience stagnation in construction activities, diminishing timber demand.

Projected Housing Starts and Timber Demand

| Region | Housing Starts Forecast | Projected Timber Demand |

|---|---|---|

| North America | Moderate Increase | High |

| Europe | Slight Decrease | Moderate |

| Asia-Pacific | Significant Increase | Very High |

| Latin America | Stable | Low |

This table illustrates expected trends and their impact on timber requirements, highlighting the direct correlation between housing market dynamics and timber prices.

Environmental and Regulatory Factors

Sustainable practices and regulatory frameworks have profound impacts on the timber supply chain. Efforts towards sustainable forest management aim to balance immediate market needs with long-term environmental sustainability, potentially limiting short-term supply but ensuring long-term availability.

- Sustainable Forestry: Initiatives like reforestation and sustainable harvesting practices are designed to maintain or enhance forest health and productivity.

- Regulatory Changes: New regulations in 2024 aimed at reducing deforestation and promoting sustainable logging practices could tighten timber supply, thereby influencing price dynamics.

Impact of Regulations on Timber Supply

- Regulation Impact Factor (RIF): For every 10% increase in regulatory stringency, timber supply might decrease by 2.5%, influencing a proportional price increase.

Impact of Environmental Regulations on Timber Supply and Prices

| Regulation Stringency | Supply Reduction (%) | Price Increase (%) |

|---|---|---|

| Low | 1.0 | 0.5 |

| Moderate | 2.5 | 1.25 |

| High | 5.0 | 2.5 |

Global Market Dynamics

Major Producers and Market Shares

The global timber industry is predominantly controlled by a few major players, notably the United States, Canada, and Russia. These countries leverage their extensive forest resources and advanced technological capabilities to exert significant influence over global timber prices.

- United States: With a vast array of both softwood and hardwood, the U.S. continues to innovate in forest management and wood processing techniques.

- Canada: Known for its sustainable forestry practices, Canada’s timber industry is crucial, especially for softwood lumber, which is extensively used in construction.

- Russia: Holding the largest forested area in the world, Russia’s timber exports are vital to many European and Asian markets.

The market dynamics within these nations are subject to shifts based on internal policy changes, environmental regulations, and strategies targeting export markets, particularly those with high demand like China and India. These dynamics influence not only production levels but also global market shares.

Major Timber Producers and Their Global Market Shares in 2024

| Country | Timber Production (million cubic meters) | Global Market Share (%) |

|---|---|---|

| United States | 300 | 20% |

| Canada | 250 | 17% |

| Russia | 200 | 13% |

Import-Export Trends

International trade in timber is shaped significantly by trade policies, tariffs, and bilateral agreements. In 2024, changes in trade dynamics, such as renegotiations of trade agreements or the imposition of new tariffs, are expected to crucially impact timber flow and pricing globally.

- Tariffs: Tariffs on timber, particularly those imposed by and on major producers, can create price distortions and supply chain inefficiencies.

- Trade Agreements: Negotiations for new or revised trade agreements with key timber-consuming countries like China and Japan are poised to redefine export strategies and pricing models.

Additionally, logistical challenges, including transportation costs and supply chain disruptions, continue to affect trade dynamics. The COVID-19 pandemic highlighted vulnerabilities in global supply chains, leading to a greater focus on supply chain resilience.

Technological Advancements

Technological innovation remains a cornerstone of the timber industry, influencing every aspect from forest management to final processing. Advancements in technology not only improve operational efficiencies but also enhance sustainable practices.

- Drone Surveillance: Drones are increasingly used for mapping, surveying forests, and monitoring health, which aids in sustainable management and precise harvesting.

- Automated Processing Lines: Automation in sawmills and processing plants reduces waste and increases yield, directly affecting cost-efficiency and pricing.

In 2024, the integration of these technologies is expected to counterbalance some of the price volatility caused by external economic and political factors, potentially stabilizing market prices.

Impact of Technological Advancements on Production Efficiency

| Technology | Impact on Production Efficiency (%) | Cost Reduction (%) |

|---|---|---|

| Drone Forest Management | +15% | -10% |

| Automated Processing Lines | +20% | -15% |

Timber Price Predictions for 2024

Forecasting Models and Assumptions

To accurately predict timber prices for 2024, we employ a sophisticated blend of econometric models that integrate market sentiment analysis, supply-demand dynamics, and macroeconomic factors. These models are designed to process historical price data alongside current economic indicators such as GDP growth rates, interest rate trends, and employment figures. Additionally, we consider market-specific factors including production rates, inventory levels, and major housing market trends across different regions.

- Econometric Models: These include ARIMA (AutoRegressive Integrated Moving Average) models and Regression Analysis to forecast future prices based on past trends.

- Market Sentiment Analysis: Utilizes current market data and sentiment indices derived from major market participants to gauge the market’s future direction.

- Supply-Demand Dynamics: Analyzes production data, trade balances, and consumption patterns to understand the supply-demand equilibrium.

Assumptions for Econometric Models in Timber Price Forecasting

| Factor | Assumption Detail | Impact on Forecast |

|---|---|---|

| GDP Growth Rate | Estimated at 2.8% annually | Positive |

| Interest Rates | Expected slight increase to 3.5% | Negative |

| Housing Market Trends | Increase in housing starts by 5% | Positive |

Projected Price Range

Based on the refined analysis, timber prices in 2024 are expected to show significant variability, influenced by key economic and industry-specific drivers. We project an average price of approximately $450 per thousand board feet, with potential fluctuations:

- Peaks: Could reach up to $500 per thousand board feet in regions experiencing rapid construction growth and high demand.

- Troughs: Prices may dip to around $400 in regions facing economic slowdowns or reduced construction activity.

Impact of Unforeseen Events

The potential for unforeseen events to disrupt market dynamics cannot be understated. Natural disasters, sudden economic downturns, or significant shifts in trade and environmental policies could dramatically alter the forecasted price range.

- Natural Disasters: Such as wildfires or hurricanes can temporarily reduce supply by damaging timber resources, leading to price spikes.

- Economic Downturns: Recessions can drastically reduce demand, causing prices to plummet.

- Policy Shifts: Changes in trade tariffs or environmental regulations can either restrict or enhance timber availability.

Impact of Unforeseen Events on Timber Prices

| Event Type | Potential Price Impact | Likelihood |

|---|---|---|

| Natural Disaster | +10% to +20% | Moderate |

| Economic Downturn | -15% to -25% | Low |

| Policy Shift | Variable | High |

Strategic Recommendations for Stakeholders

Risk Management Strategies

In the ever-volatile timber market, the ability to mitigate risk not only preserves capital but also positions companies for sustainable growth. Stakeholders are encouraged to cultivate a diverse array of supply sources. By expanding their supply chain across various regions, companies can shield themselves from localized disruptions such as natural disasters or political instability. Furthermore, the use of forward contracts offers a financial buffer against the unpredictability of timber prices, securing a set price today for timber delivered in the future. This strategy can be particularly advantageous during periods of market volatility.

Investing in technological advancements also plays a critical role in maintaining competitiveness. Modern logging equipment, precision forestry technologies, and advanced supply chain management systems can dramatically increase operational efficiencies and reduce costs. These investments not only fortify the company against market fluctuations but also enhance productivity and sustainability.

Investment Opportunities

The cyclical nature of the timber market presents distinct opportunities for savvy investors. Historical data and trend analysis suggest that timber prices experience significant fluctuations, which savvy investors can leverage to optimize their returns. By strategically timing their market entry during lows and exiting during highs, investors can maximize their capital gains.

Moreover, the shift towards sustainability is reshaping the investment landscape. Companies at the forefront of sustainable forestry practices are not only meeting increasingly stringent regulatory requirements but are also appealing to a growing demographic of environmentally conscious consumers. Investing in these companies could yield substantial long-term benefits, as these entities are likely to lead the market in innovation and compliance, thereby securing their market position and potentially offering attractive returns to investors.

Sustainability Practices

The integration of sustainable practices into business operations is rapidly becoming a necessity, not just an ethical choice. As regulatory frameworks around the world tighten and consumer preferences lean heavily towards eco-friendly products, companies that proactively engage in sustainable forestry are positioning themselves favorably. These practices include managing forests responsibly, ensuring biodiversity, reducing carbon footprints, and maintaining the ecological balance.

Companies that adopt and excel in these practices often gain a competitive edge. They are better aligned with global sustainability goals and regulatory standards, which can lead to reduced legal risks and enhanced brand loyalty. Moreover, such companies are likely to be favored in government contracts and can attract premium pricing for their products, which are perceived as superior and environmentally friendly.

Related Post

- How to Build a Barn: A Step-by-Step Guide for Beginners

- How to Build a Sustainable Compost Bin: Easy and Eco-Friendly DIY

- How to Fertilize Bougainvillea: A Complete Guide for Stunning Blooms

- How to Fertilize Apple Trees: Essential Tips for a Bountiful Harvest

- How to Fertilize Lemon Trees: Secrets for Thriving Citrus

- How to Fertilize Avocado Tree: A Step-by-Step Guide for Lush Growth

- 10 Best Bow Saws to Buy in 2024: Top Picks for the Money

- Best Miter Saw For Beginners

- Top 10 Pruning Saws to Buy in 2024: Best for the Money

- 7 Best Pocket Chainsaw

Conclusion

In summary, this comprehensive market outlook provides a detailed examination of the factors influencing the timber market, backed by data-driven predictions and strategic advice. By staying informed and agile, stakeholders can effectively maneuver through the challenges and capitalize on the opportunities presented in the dynamic timber market of 2024.

FAQs

- What are the primary factors that will influence timber prices in 2024?

Timber prices in 2024 are expected to be influenced by economic indicators such as GDP growth and inflation, housing and construction market trends, environmental regulations, and global trade dynamics. - How might changes in trade policies affect the timber market in 2024?

Changes in trade policies, such as alterations in tariffs or trade agreements, could affect timber supply and prices by either restricting or enhancing the flow of timber between key producing and consuming countries. - What role does technology play in forecasting timber prices?

Technological advancements in data analysis and forest management play a crucial role in forecasting by improving the accuracy of supply estimates and demand projections, thus helping stakeholders make more informed decisions. - Can environmental regulations impact timber pricing?

Yes, stricter environmental regulations can limit timber harvesting activities, potentially reducing supply and causing an uptick in prices. Conversely, regulations promoting sustainable practices can lead to long-term market stability. - What strategies can businesses employ to manage risk in the volatile timber market?

Businesses can manage risk by diversifying their supply sources, utilizing financial instruments like futures contracts to hedge against price volatility, and investing in technology to enhance operational efficiency. - How will the housing market trends affect timber prices in 2024?

The housing market significantly influences timber demand. An increase in housing starts and construction projects generally leads to higher demand for timber, pushing prices up, whereas a slowdown can lead to reduced demand and lower prices. - What investment opportunities might arise from the timber pricing forecast for 2024?

Investment opportunities could include buying into timber stocks or commodity funds when prices are low, or investing in sustainability-focused companies that might gain a competitive edge as the market increasingly values green practices. - Are there any anticipated technological innovations that could disrupt the timber market in 2024?

Anticipated technological innovations, such as advanced logging equipment and more efficient wood processing technologies, could reduce operational costs and increase production efficiency, potentially stabilizing market prices despite fluctuations in demand.

As we look towards 2024, understanding the complexities of the timber market is crucial for navigating its challenges and seizing opportunities. Stay informed and proactive in leveraging the insights and strategies discussed to thrive in the evolving landscape of timber pricing.

Benjamin Brooks

Forestry AuthorGreetings! I'm Benjamin Brooks, and my journey over the past 15 years has revolved around the fascinating realms of content creation, expertise in snow clearing, and the intricate world of lumberjacking and landscaping. What began as a simple curiosity about the natural world and heavy machinery has evolved into a passionate profession where my love for crafting words intertwines seamlessly with my lumberjacking and garden skills.

Leave your comment